3/17/2023, 7:27:55 AM

Government Initiative to Help Real Estate Industry Post COVID-19

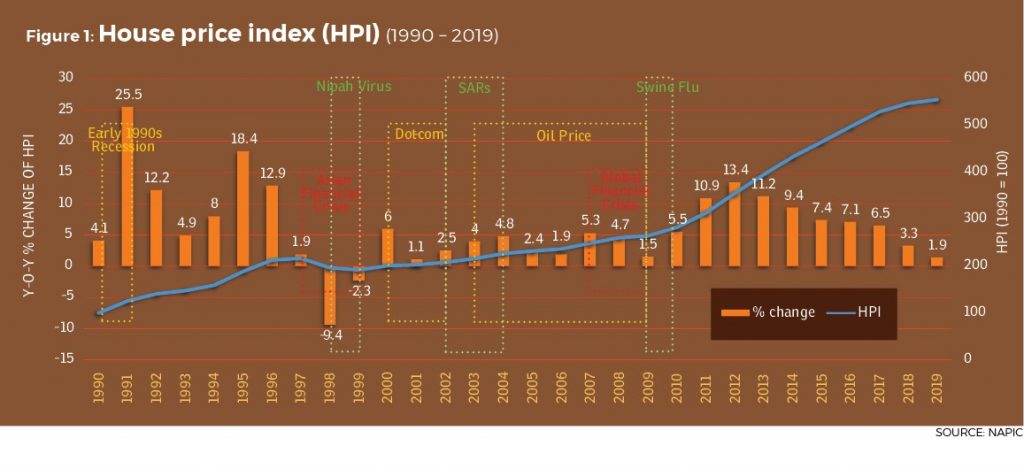

Since the 1990, there have been at least 15 global crises that have impacted economic stability across many countries. These include crises triggered by speculative financial bubble bursting, a stock market crash, a sovereign default, or a currency crisis. Disease outbreak has now become a part of the causation to economic crises which include the severe acute respiratory syndrome (SARs), Nipah virus and currently, the Coivd-19 pandemic.

The real estate industry, although resilient, continue to be battered by the unstable economic outlook that subsequently contributes towards low sales conversion. Since the 1997 Asian Financial Crisis, house prices have struggled to reach the all-time high it once achieved before (Figure 1). With the implementation of the Movement Control Order (MCO) since 18th March 2020, the real estate industry has encountered a large setback in business opportunities, exacerbated by the high property overhang carried forward from 2019 as well as the financial capabilities of Malaysians.

There were fewer home seekers due to fears of the virus outbreak while buyers were unable to complete the buying process as operations of various governing bodies were put on hold. Even real estate agents were unable to conduct conventional home viewings due to strict social distancing and travelling measures which further reduced the likelihood of buying opportunities for interested homeowners or investors.

What does the short-term effect of COVID-19 look like?

In the short-term, the real estate industry will be temporarily stagnate or even worsen as buyers and investors are expected to become more conservative in their spending, avoiding luxury purchases or big-ticket items such as properties during these tough times. It is likely that potential buyers will opt for a wait-and-see approach in the second half of 2020 before choosing to resume spending on properties in early 2021.

What are the long-term effects of COVID-19?

While a drop in sales will be a definite short-term effect, the long-term impact of the Covid-19 outbreak will be exhibited in consumer lifestyle, transforming the way the live, work and shop; thereby changing the associated real estate requirements. A prime example would be the downsizing of office spaces as business digitalization continues to grow and the ability to work remotely becomes a commonality. Further, with the increase attention on e-commerce businesses, demand for retail spaces will continue to decline as more consumers rely on their smart devices to obtain services rather than walk into physical stores.

New Real Estate Incentives Post- Covid-19 Pandemic

To overcome these potential setbacks, the Malaysian Government has stepped in to provide several initiatives with the aim of boosting consumer demand for real estate. Hence the Economic Recovery Plan (PENJANA) was announced by Prime Minister Tan Sri Muhyiddin Yassin which includes several key initiatives in hopes of minimising any major setback in the industry in light of the soft market predictions.

- The Home Ownership Campaign (HOC)

First introduced in 2019, the HOC was intended to facilitate new home ownership among Malaysian citizens. It has since been reinstated effective 1st June 2020 until 31st May 2021. To recap, there were several criteria under the HOC 2019: –

- This campaign was only applicable for residential properties purchased by Malaysian citizens (foreign buyers do not qualify);

- The purchase must be of a new property from a property developer (and not sub-sale); and

- A minimum 10% discount given by the developer to the purchase eligible properties that are registered with REHDA Malaysia (for Peninsular Malaysia) and SHEDA or SHAREDA (for Sabah and Sarawak).

- Subject to the actual wording of gazetted legislation, it is yet to be confirmed whether the other criteria in the HOC 2019 will continue to apply for HOC 2020.

- Stamp Duty exemption as part of HOC

Stamp duty exemptions are granted for instruments of transfer (partial exemption) and loan agreements (full exemption) for sale and purchase agreements signed from 1st June 2020 until 31st May 2021. The reintroduction of the Home Ownership Campaign (HOC) for 2020 provides a partial exemption of the stamp duty for residential properties priced between RM 300,000 to RM 2,500,000 (before 10% discount), subject to at least 10% discount provided by the Developer.

The stamp duty exemption on the instrument of transfer is limited to the first RM 1,000,000 of the home price (which translates to a maximum stamp duty saving of RM 24,000 for a property priced at RM 1 million), while full stamp duty exemption is given to the loan agreement. However, do be reminded that stamp duty of 4% will likely still apply to amounts above RM 1 million.

- 70% margin of financing limit

The 70% margin of financing limit that was applicable for 3rd residential property valued at RM 600,000 and above will be uplifted. However, the ability to obtain loans is subject to internal risk management and assessment of the respective financial institutions.

- Real Property Gains Tax (RPGT) exemption

From 1st June 2020 to 31st December 2021, the gains arising from disposing residential property is now exempted for all Malaysian citizens. It is unclear if Malaysian PRs are included, but foreigners and companies appear to be excluded for the time being. The RPGT exemption is limited to the disposal of three units of residential property per individual during the prescribed period.

As highlighted by Sarkunan Subramaniam, Managing Director of Knight Frank Malaysia, the reintroduction of the HOC will likely act as an immediate catalyst to address the challenge of clearing property overhang and facilitate cash-flow opportunities for developers. Moreover, the RPGT exemption aims to encourage further traction to the secondary housing market, especially for those who are looking to liquidate their assets in the near future during the bad economy.

Although the current economic climate may appear less than ideal for the time being, the incentives in place offer a promising outlook on the real estate industry. No doubt there will be further supplementary perks to the current incentives announced by financial institutions as well as developers that are looking to enhance the property market and support the national economy as a whole in the long-term.