3/17/2023, 4:36:32 AM

The Effects of Covid-19 on Real Estate Industry : What Does the Post-pandemic Reality Look Like

The COVID-19 pandemic has had a sudden and significant impact on all aspects of people’s lives with 2.6 billion across the world now living under some form of lockdown, restricted movement or quarantine. As the number of positive cases continues to increase, it is expected to have a profound impact not only on tourism, services, and manufacturing industry; but also on the property industry. Analysis and forecast previously conducted concerning Malaysia’s property outlook in the near future did not take into consideration the Covid-19 outbreak or the movement control order (MCO) and their resulting effects on the economy.

The short-term human and economic impact is undeniable as people stay home, offices, malls and public facilities close, and production stalls. Once the risk to human life has reduced and steps are taken back toward a fully productive economy, it is worth spending some time envisaging what this ‘new normal’ might look like for the ever-changing climate within the real estate industry.

Prior to the pandemic, Asia Pacific was the largest region in the global real estate rental market, accounting for 32% of the market in 2019. Western Europe was the second largest region accounting for 29% of the global real estate rental market. Africa was the smallest region in the global real estate rental market.

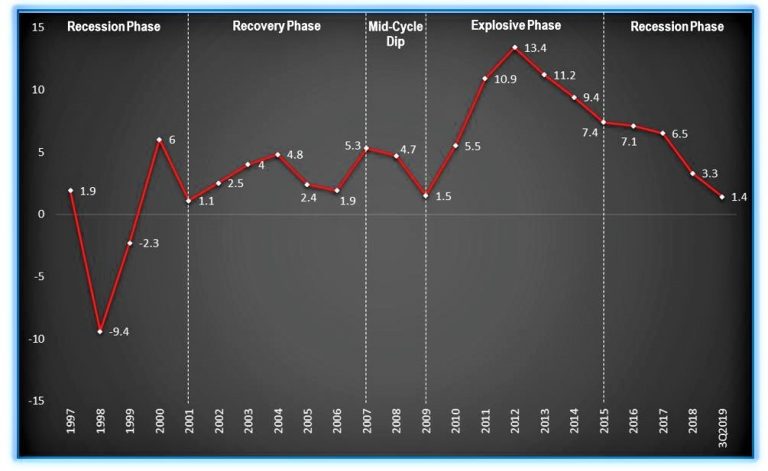

In the Malaysian context, we refer to the National Property Information Centre (NAPIC) whereby the country’s property market entered a recovery phase in 2001 after the Asian financial crisis. The anticipated mid-cycle dip occurred between 2007 – 2009 during the subprime mortgage crisis, followed by an explosive phase where prices continued to escalate from 2010 to 2015, with maximum increase up to 13.4% per annum. The recession phase that kicked in after 2015 served to highlight the stark difference in house prices compared to affordability, volume of properties overhang, accessibility to property financing, weak ringgit against major currencies and overall cautious consumer sentiment.

In light of the current uncertainties, the country’s continued sluggish property market is expected to be exacerbated by consumers tightening their belts, adopting a wait-and-see approach rather than readily invest or purchase properties to move into. Restrictions and uncertainty around valuation is limiting investors’ ability to perform due diligence, and it is more challenging to execute transactions given the shortened operation hours and strict social distancing measures. Delayed launches and elongated transaction timelines are also increasingly evident in affected markets as city lockdowns, travel restrictions and social distancing become commonplace around the world.

As we begin the ‘recovery phase’ of the 2.5 month movement control order (MCO), real estate developers and agencies will have to adapt to the new normal to maintain a stable foothold and stay afloat during this cautious spending period. Business digitalization will play an important role in capturing the spending appetite of potential buyers, enticing their interest to buy properties during a time when saving up will be the default mindset. Attractive online marketing tools coupled with attractive incentives by the government, banks and developers will serve as a key element to weather the soft market as global investment activities is expected to slow. Many have turned to collaborative partnerships between real estate agencies or e-commerce platforms as a means to test the effectiveness of digitalizing conventional business practices such as trainings, property booking transactions, property management monitoring and report, etc.

On the other hand, in China, life is shifting back to normal for most locations outside of the Hubei province, where the outbreak began. Manufacturing is returning to roughly 90% of full capacity while circa 80% of retail, restaurants and bars are now open. Transactional activity is gradually improving across the region, and investor appetite is growing. However, there is concern in markets such as Singapore, which was initially less affected, where infection case counts have risen due to residents returning from abroad.

While many investors have paused new acquisitions, select well-funded institutions and high-net-worth investors with longer-term investment horizons will be among the first movers, concentrating on these sectors. Real estate continues to offer good risk-adjusted returns that are less correlated to other asset classes. It is worth noting that the epidemic is just an accelerator to the changes that have already kickstarted in the consumers’ lifestyle. A closer look at the last decade reveals that portability and connectivity of technology via smart devices have played a significant role in shaping and shifting consumers’ attitudes, values and buying behaviours. As the effects of COVID-19 are felt around the world, real estate agencies and developers alike will have to implement recovery plans that considers short- and long-term effects of the pandemic, anticipate consumer appetite and revise business operations to better adapt to economic uncertainties.